Vietnam’s tourism industry is growing rapidly, offering businesses ample opportunities to thrive. However, ensuring a seamless customer experience is crucial to stay competitive, especially in payments. By implementing modern payment solutions like Payment Links, businesses can provide convenience, security, and efficiency for travelers.

Enhancing payment experience in the tourism industry

The tourism sector in Vietnam is witnessing remarkable growth, bringing numerous opportunities for travel businesses. However, in such a competitive market, optimizing the customer experience is essential. One of the critical aspects that influence customer satisfaction is the payment process.

Importance of payment optimization

To ensure the best experience, from booking to payment and on-site transactions, every touchpoint must be carefully designed. Implementing popular and seamless payment solutions allows travel businesses to enhance customer satisfaction and streamline transactions efficiently. A smooth payment experience builds trust and encourages repeat bookings and positive reviews. In contrast, a complex or unreliable payment system can result in lost customers and negative feedback, ultimately impacting revenue.

Common payment challenges in tourism

Many travel businesses struggle with issues such as:

Transaction failures: Payment processing errors can frustrate customers and lead to abandoned bookings.

Slow payment processing: Delays in confirming payments can create uncertainty for both customers and service providers.

Security concerns: Travelers are often wary of fraud and data breaches, making them hesitant to enter their payment details.

Limited payment options: Some customers may prefer specific payment methods that are not available, resulting in lost sales.

One of the critical aspects that influence customer satisfaction is the payment process

What do travelers expect from the payment experience?

Today’s travelers prioritize transparency, speed, and security in all transactions, including payments for travel services. They expect to complete payments online, compare prices easily, and proceed without any barriers.

Convenience and security

To meet the growing demand for online payments from both domestic and international travelers, many businesses are integrating Payment Link solutions. These provide a secure and efficient method, enhancing the professionalism and convenience of payment processes for travelers.

Travelers expect a frictionless experience where they can:

Pay using their preferred method (credit card, e-wallet, QR code, etc.).

Avoid excessive fees or hidden costs.

Complete payments instantly without technical difficulties.

Trust that their personal and financial data is protected.

Multi-currency and global payment support

With an increasing number of international tourists, businesses must ensure their payment systems support multiple currencies and international payment methods. This helps provide a smooth and accessible experience for all travelers.

Key benefits of multi-currency support include:

Simplified transactions for international travelers.

Reduced currency conversion fees for customers.

Higher conversion rates as customers feel more comfortable paying in their local currency.

Businesses must ensure their payment systems support multiple currencies and international payment methods

What is a payment link solution?

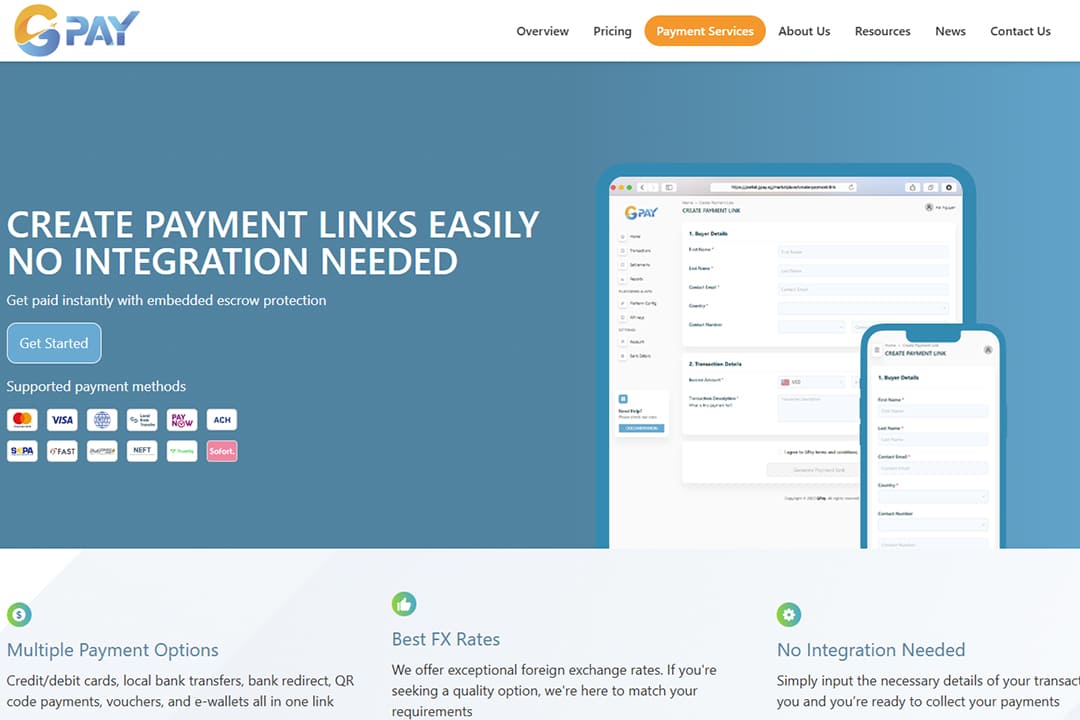

Payment Link is a flexible online payment method that allows businesses to generate secure payment links via third-party payment providers. This solution improves digital payment experiences, increases conversion rates, and offers greater convenience to customers.

How payment links work

With Payment Links, businesses can send payment requests through email, SMS, or social media. Travelers only need to click the provided link and complete the payment via various methods, such as ATM cards, e-wallets, QR codes, and credit cards, ensuring a seamless experience.

Advantages of payment links for tourism

Quick and hassle-free transactions for both businesses and customers.

Secure payment processing with fraud detection mechanisms.

Reduced operational workload by automating payment requests.

Higher customer satisfaction by offering a smooth and reliable payment method.

Increased conversion rates by eliminating friction in the booking process.

Payment Link is a flexible online payment method that allows businesses to generate secure payment links via third-party payment providers

Why choose GPay?

GPay, a global payment gateway, is a highly recommended solution for tourism businesses.

Advantages of GPay

GPay is a leading global payment gateway, specifically designed to support businesses in high-risk industries, including travel and gaming. Its robust features make it an ideal choice for businesses looking to optimize their payment processes. Here are some of the key advantages of GPay:

Multi-currency support: Accept payments in multiple currencies, making it easy for businesses to cater to international travelers without worrying about conversion issues.

Worldwide transactions: GPay supports transactions in over 173 countries with multi-currency and diverse payment method options.

Secure payment processing: With PCI DSS compliance and advanced fraud prevention tools like 3D Secure authentication, GPay ensures safe transactions.

Seamless integration: GPay integrates smoothly with travel booking systems and other e-commerce platforms, reducing technical complexities.

User-friendly platform: GPay offers an intuitive and easy-to-navigate interface, allowing businesses to set up and manage payments efficiently.

Real-time analytics and reporting: Businesses can access detailed transaction insights, helping them make informed financial decisions and optimize revenue streams.

GPay is a highly recommended solution for tourism businesses

GPay’s payment link: A smart payment solution

GPay offers an innovative Payment Link solution that allows businesses to create and share payment links for fast and secure transactions. This feature is particularly useful for travel companies that need a flexible and efficient way to collect payments from customers.

With GPay’s Payment Link, businesses can:

Generate unique payment links in just a few clicks.

Share payment links via email, SMS, or social media for convenient customer payments.

Accept multiple payment methods, including credit cards, e-wallets, and bank transfers.

Monitor transactions in real time and automate payment tracking.

How to create a GPay payment link

GPay provides a straightforward solution for generating Payment Links. Here’s how to set up and use GPay’s service:

Log in to the GPay Dashboard and select “Create Payment Link”.

Enter seller and buyer details. If the buyer is new, click “Add New Buyer” to input their information.

Complete transaction details with accurate information for smooth processing.

Set the currency, transaction amount, description, and upload supporting documents if necessary.

Generate the Payment Link and share it with customers to start accepting payments instantly.

GPay provides a straightforward solution for generating Payment Links

Conclusion

Optimizing the payment experience is a crucial factor in elevating customer satisfaction and ensuring a seamless journey for travelers. An efficient payment system helps businesses reduce operational complexity, minimize fraud risks, and increase customer trust. By integrating solutions like Payment Links, especially through providers like GPay, tourism businesses can offer secure, fast, and hassle-free transactions. Contact GPay today to get the support you need about payment links.